African Bank Fixed Deposit

Fixed Deposit Maximum nominal interest rate over 60 months 8.00% Minimum opening deposit of R10 000.

Looking for the best bank to keep your money? With so many banks in South Africa that offer multiple savings accounts each, it can be extremely confusing.

- BANK NAME: FIXED DEPOSIT INTEREST RATE(%) African Banking Corp. Ltd: N/A: Bank of Africa Kenya Ltd. 3-6: Bank of India: 3-5: Bank of Baroda (K) Ltd: 3-5: Barclays Bank of Kenya Ltd.

- Re: Is African Bank Safe - Fixed deposit « Reply #17 on: March 08, 2017, 03:14:23 pm » Hamster - also on the TFSA accounts the only reason I am putting money into them is because you can trade over this account as, as yet Treasury have not closed this loop hole - so no need to observe the 3 year holding period.

I know because I’m in the process of finding the best savings bank account myself. I was astounded by the lack of information online so I thought I better research my findings.

To make life a bit easier for you, below you’ll find a breakdown of the best interest rates on savings accounts within South Africa. Hope this helps!

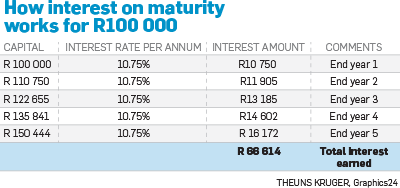

1. African Bank fixed deposit account tops the list! Their interest rates start out at 7.7% interest for the first 3 months and can be increased to as much as 10.75% interest the longer you hold your money, which is outstanding. [View Bank]

Side note: As discussed in this quora post, only the best investors in the world achieve a 10% return on their investment in the long term. So finding a bank that offers 10% interest on your money is truly special.

2. Tyme bank GoalSave account tops the list. They offer the best interest rate at 6% interest per annum from 1-30 days after the money has been added to your account. This increases the longer you hold your money to us much as 10% interest. Unfortunately your maximum initial investment is capped at R10,000. This can be increased to up to R100,000. [View Bank]

3. Capitec Global One account offers 4.75% interest on your everyday account which can be increased the more you deposit. Over R100,000 will give you a 5.5% interest rate. However, with a fixed savings account they offer as much 8.55% interest. [View Bank]

4. Nedbank offers a wide range of flexible and fixed term savings accounts. A fixed term savings account offers from 6.5% to 8% interest rates depending on the term and amount you deposit. [View Bank]

05. Absa interest rates for savings account ranges from 3.5% to 6.9% depending on the account selected and amount deposited. I highly suggest your minimum deposit is over R10,000 to make it worth your while. Their fixed deposits offer interest rates between 7.10% to 7.6%. [View Bank]

Fixed Deposit Investing

06. Standard bank also has a big variety of savings account options. They offer interest rates from as low as 2% to as high as 9% depending on how much you deposit, and how quickly you would like access to that money. They have 4 “accessibility” options so make sure you check out the bank to get a detailed description. [View Bank]

07. FNB has a high initial interest rate of 5% on a low deposit, however on the other side of the spectrum they max out at only a 6% interest rate for investments of R100,000 plus. Which is extremely poor compared to option 1-6. [View Bank]

Did we miss a bank? Or did we miss any info? Please let us know below. Hope this information saves you a few hours of research. I know I wish I had it when I was researching my savings account.

With a rich history in the South African financial services industry, African Bank has gained a reputation as a trusted institution. Since being re-launched in 2007, the bank has continued to grow. It has gained more clients and has provided some much-needed services in the form of credit facilities.

With a value system aligned with enhancing the customer experience, African Bank believes that credit should work to improve lives and help individuals move forward. African Bank ensures that clients are given all necessary information to make informed decisions.

African Bank Fixed Deposit Rates Calculator

The Bank also offers a range of saving and investment tools. One such tool is the African Bank 5 Year Term Deposit.

African Bank Fixed Deposit Interest Rates

More about the African Bank 5 Year Term Deposit

According to an article in Fin24:

“Many people like to keep a certain percentage of their savings in a bank account where it earns some interest; but they can get access to it, in case of emergencies.”

One of the reasons that people often choose high interest savings accounts is that they can earn interest, while also giving them the option of being able to withdraw the funds very easily. This is one of the advantages of having a term deposit.

African Bank Fixed Deposit

African Bank offers Term Deposits ranging from 3 months up to a maximum of 60 months. Clients get a fixed interest rate for the duration of their investment.

Interest can be paid out monthly, every 6 months, 12 months, or upon maturity. Additional deposits are allowed for the first 7 days after the initial funding.

The amount of interest you will be earning will depend on the amount of cash you put into this fixed period plan, with the top end being 13+ % (that is a very decent interest rate!)

A R500 minimum deposit is required, along with proof of residence and a valid ID.

Enter your details online and an African Bank consultant will assist you.

If the African Bank 5 Year Term Deposit seems like too much of a long term commitment, check out the African Bank 7 Day Notice Account.