Best Ira Cd Rates

Getting an IRA CD

IRA CDs can be added to an IRA portfolio, regardless of whether it’s a traditional, Roth or SEP IRA. IRA CD rates are competitive and this type of CD has almost no risk — but does have a guaranteed return.

Best Ira Cd Rates In Ohio

Best 6-month IRA CD Communitywide Federal Credit Union (Traditional, Roth) CommunityWide Federal Credit Union is offering the highest rate available on 6-month IRA CDs at 0.70% APY for deposits of $1,000 and over.

The best IRA accounts — which are basically tax-advantaged accounts to help you start saving for retirement — come with plenty of lucrative and high-quality investment options for you to choose from. One of the most popular no-risk investments you can use to round out your portfolio is an IRA certificate of deposit (CD), also commonly known as an IRA CD.

- Certificates of Deposit - Branch Banks 2021. A certificate of deposit (CD) is a savings product offered by a bank in which a depositor (someone who has money to put into the bank) agrees to commit a certain amount of money for a set period of time, in return for a fixed rate.

- Below are the best one-year CD Rates from banks in Maryland. One-year CDs are usually the most popular term and offer a decent yield without having to lock-up money for an extended period of time. One year CD Rates.

- With a variety of CD terms to choose, ranging from 91 days to 60 months, Spencer can help you meet your savings goals with some of the best cd rates in NJ. IRAs Our IRA accounts give you tax advantages while you save for your retirement.

- IRA CDs can be a safe way to invest for retirement. The key is to find high yields. To help, here are some of the best IRA CD rates available today (March 3, 2021).

If you’re asking yourself “what is an IRA CD?” or “what are the best IRA CD rates?” then you’re asking the right questions. The best IRA CDs offer great return rates, flexible term lengths, low early withdrawal penalties and a streamlined investment process.

Compare the 6 best IRA CD rates of 2020

6 best IRA CD lenders of 2020

- Ally Bank — Best online bank

- Alliant — Best credit union

- Capital One — Best mobile app

- Discover — Best one-stop banking

- TIAA Bank — Best for yield pledge promise

- Synchrony — Best customer service

Ally Bank — Best online bank

High-yield IRA CDs from Ally Bank are available with term lengths from 3 months to 5 years. The APR rates on IRA CDs span from 0.50% to 1.15% APR and increase as the term length increases. There’s no balance requirement to open an Ally IRA CD, and the bank will let you choose between two rates on your CD: the rate that’s available the day you open it or the day you fund it — whichever is higher. The limit on that rate guarantee is 90 days, and Ally Bank CDs can be opened and managed completely online.

Alliant — Best credit union

Banks aren’t the only institutions to offer IRA CDS; credit unions also offer IRA CDs. Alliant Credit Union has IRA CDs available with terms from 12 months to 60 months. APY rates range from 0.65% to 0.75% depending on the term. Alliant’s minimum deposit requirement is low — only $1,000 — and this credit union has no maximum deposit amount on CDs. The dividends are compounded every month and at maturity, and funds are insured up to $250,000 by NCUA.

Capital One — Best mobile app

Best Ira Cd Rates Nj

Capital One offers IRA CDs with term lengths from 6 months to 60 months. Rates are competitive, ranging from 0.25% on 6-month IRA CDs to 1.00% on 60-month IRA CDs. Capital One IRA CDs have no account minimums, which means that no one will be priced out of this investment option. Capital One also has a highly-rated mobile app available to help you manage your IRA CDs and other accounts.

Discover — Best one-stop banking

Opening an IRA CD through Discover will require a larger initial investment than many of the competitors, with a minimum of $2,500 to get started. The APY rates on Discover IRA CDs range from 0.90% to 1.15%, and term lengths range from 12 months to 5 years. If you’re looking for term length flexibility, Discover offers it.

TIAA Bank — Best for yield pledge promise

If you’re worried that you’re missing out on better IRA interest rates elsewhere, the yield pledge promise from TIAA Bank was made for you. This bank guarantees it looks at comparable banks weekly and will adjust its rate to ensure it’s offering a rate in the top 5% of offers, so the rate you open your IRA CD at will likely be in the higher tier. IRA CDs with TIAA are available with terms from 3 months to 5 years, with rates from 0.35% to 1.35% APY. The minimum to open an account with Yield Pledge is $5,000, but the bank also offers a basic CD and a bump-rate CD with smaller deposit requirements, though you are not guaranteed higher rates.

Synchrony — Best customer service

Synchrony offers competitive IRA CDs with terms from 3 months to 5 years. Rates range from 0.25% to 1.20% APY depending on the term length. The minimum opening balance of $2,000 is a little high, but what’s great about Synchrony is the excellent customer service, and the bank even has dedicated customer support phone lines for long-term customers.

What is an IRA CD?

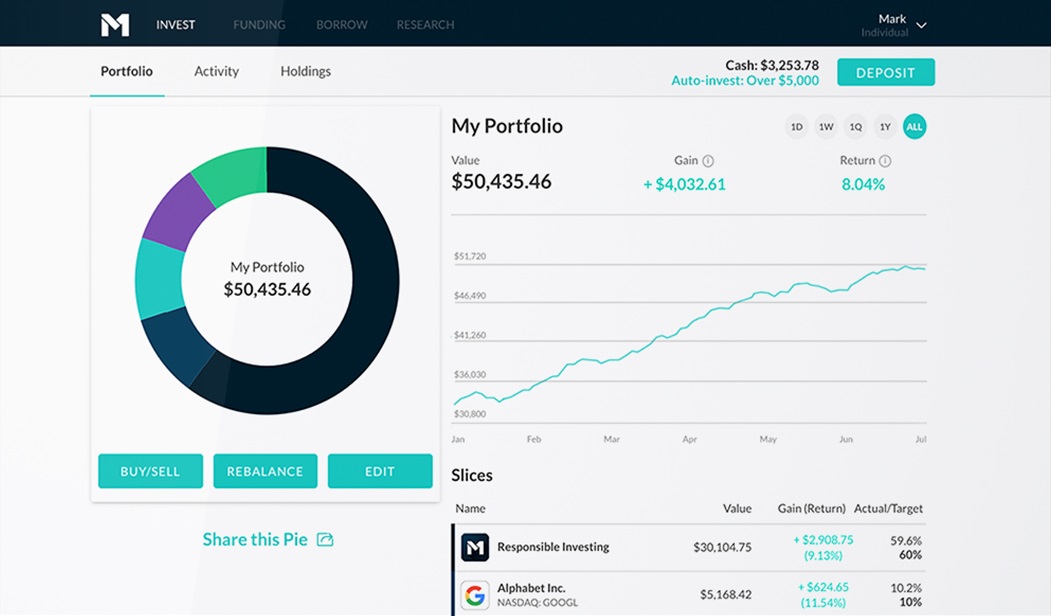

An IRA is a tax-advantaged account that you can set up when saving for retirement. Within your IRA account, you can have many different types of investments, much like a standard investment portfolio, including certificates of deposit (or CDs).

A CD gives you a fixed-rate, no-risk return for investing money that you leave untouched for a certain period of time. An IRA CD is basically just a standard investment CD — the only difference is that it’s part of your retirement savings account.

IRA CD vs. other investment accounts

IRA CD vs. standard CD

Standard CDs and IRA CDs operate similarly. With both products, you are given a guaranteed rate of return in exchange for leaving a sum of money deposited for a certain period of time. The main difference is that an IRA CD is housed within a retirement account and a standard CD is simply a standard investment account.

When your IRA CD matures, the funds stay within your IRA account. With a standard CD, you can cash out and use the funds as you please. The one exception is a Roth IRA, which allows you to withdraw contributions at any time without penalty. Compare CD rates to see the difference between the two.

IRA CD vs. IRA account

Comparing an IRA CD to an IRA account is a little like comparing apples to oranges. An IRA CD is a type of investment that is part of a portfolio account, and an IRA account is the portfolio account that houses investments like IRA CDs.

The term IRA account refers to the entire investment portfolio that you have. This can be a SEP, Roth or traditional IRA account. Within each of those accounts, you have different types of investments. One of those investment options is an IRA CD. Basically, an IRA CD is an investment that is part of an IRA account.