Mobile Check Deposit Bank Of America

Point. Click. Deposit. See how easy it is to deposit a check using the MyMerrill Mobile app!

- Boa Deposit Check By Phone

- Mobile Check Deposit Limits Bank Of America

- Maximum Mobile Check Deposit Bank Of America

- Bank Of America Check Deposit Mobile Limit

- Mobile Check Deposit Bank Of America Time

MyMerrill Mobile Check Deposit

Mobile check deposit provides you a secure and convenient option right from your home! Important Information: Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (BofA Corp.). Bank of America Credit account (Credit card, charge card, loan, line of credit) 11:59 p.m. ET for same-day credit. Bank of America Mortgage: For customers who pay with their Bank of America Checking or Savings account, 5:00 p.m. ET cutoff time gives you same-day credit: Bank of America Vehicle loans. Mobile Check Deposit Limits at the Top U.S. Bank of America. The Bank of America mobile check deposit limit are $10,000 per month for accounts opened for 3 months or longer; for accounts.

Mobile Check Deposit on the MyMerrill mobile app allows you to securely and conveniently deposit checks anytime and anywhere into eligible Merrill investment accounts.

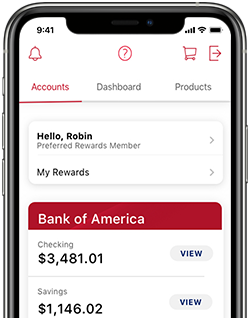

Once you log into the MyMerrill mobile app:

- Tap on the check deposit icon.

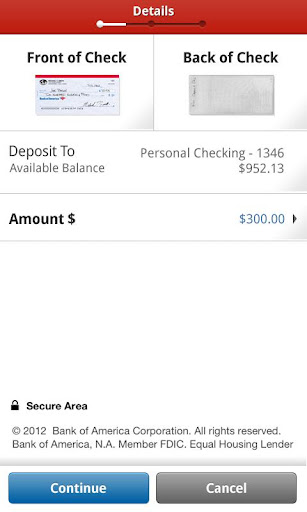

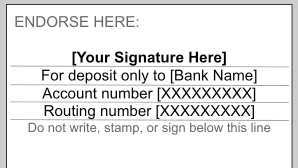

- Using your device’s camera, take a picture of both

sides of the check. - And remember to sign the back.

- Select your deposit to account & enter the

amount. - Tap continue to verify the deposit, and lastly

finally, tap “make deposit” to process therequest.

A confirmation notice will appear on the screen letting you know it the check was accepted.

- You may can check the status of your deposit at

any time by returning to the app,selecting “check deposit” and then “view status.” - Deposits made after 7:30 p.m. Eastern Time will

be processed on the next business day. - It may take up to eight days before you can invest

or withdraw the funds. - The check should be kept for 14 days to ensure

the issuer has honored the payment.

Mobile check deposit provides you a secure and convenient option right from your home!

Important Information:

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (BofA Corp.). MLPF&S is a registered broker-dealer, Member SIPC and a wholly owned subsidiary of BofA Corp.

Investment products:

- Are Not FDIC Insured

- Are Not Bank Guaranteed

- May Lose Value

Nothing discussed or suggested in these materials should be construed as permission to supersede or circumvent any Bank of America, Merrill Lynch, Pierce, Fenner & Smith Incorporated policies, procedures, rules, and guidelines.

Boa Deposit Check By Phone

Neither Merrill Lynch nor any of its affiliates or financial advisors provide legal, tax or accounting advice. Clients should be instructed to consult with their legal and/or tax advisors before making any financial decisions.

© 2020 Bank of America Corporation. All rights reserved.

Learn the procedure to follow when depositing mobile checks at Bank of America. This article will also include check depositing limits and the time taken to process mobile check deposits. If you also wish to know how to cancel mobile check deposits, continue reading this article.

Contents

- How to deposit a check online at Bank of America

- Mobile check deposit Bank of America FAQs

How to deposit a check online at Bank of America

The Bank of America is one of the most accepted and used banks in the USA. Just like the other financial institutions, this bank has also attained a great deal and moved its services into the digital world.

Now you can deposit your check online from your destination; it can be at home, school, or workstations, without physically visiting the bank or its ATMs.

The process for depositing your check at this bank through the online method is indeed easier. Just follow the following few steps and you will be done in less than 30 minutes.

Step 1: Confirm that you have a strong internet connection

This is an important step. With strong internet connectivity, you are likely to spend less time depositing your check online.

Kindly, if you find that you find you have slow internet connections, use another option of depositing your check such as visiting the bank or move to a nearby cyber for strong internet connection.

Step 2: Confirm that your check is not fake

Confirmation of the genuineness of your check is the second most important step. It lowers the possibility of your check being rejected.

Step 3: Download the Bank of America official application

The app is available online at Google Play Store. Just download it or if you have it, go to the next step.

Step 4: Sign in to access your checking account or savings account

In case you find it difficult logging in, you can request for help from the Bank of America customer care team.

Step 5: Take a picture of your check

When taking the picture, make sure that you capture all the important details such as the amount and endorsement area.

Step 6: Upload your check

To upload your check is easier because there are steps and guidelines throughout the app, which are meant to guide you. Once you have uploaded the check, ensure the details you have entered are correct and submit your check for processing.

Step 7: Completion of depositing

You will receive a notification, once you are done. If it’s unsuccessful, you are requested to try again after rectifying the issue that could have led to the rejection of your check.

How long does Mobile check at BoA take?

Depositing a check through the BoA app usually takes twenty to thirty minutes. After this period, you will receive notification that your check has been accepted or not.

If it has been accepted, you are likely to see your money in your account after a maximum of fifteen days. The period depends on the number of clients who are using the application.

BoA mobile check deposit time

If you have a strong internet connection, you are likely to spend less than 20 minutes to have your depositing process done. However, if your internet is slow, you may take a little bit longer.

BoA Mobile check deposit Limit

The mobile check deposit feature of this bank has some deposit limits, depending on the client’s time with the financial institution, and the type of your account.

Those with an account that has been active for less than 90 days are allowed to deposit 1,000 dollars a month. But, for those whose account has been operational for over three months, they can deposit up to 5,000 dollars in a single month.

Cancel Mobile Check deposit at Bank of America

As an esteemed client, you are given a chance to request the cancellation of your mobile check deposit. However, when requesting a cancellation, you are expected to give the reason why you are doing so.

After that, you will wait for a notification that your check deposit has been successfully canceled. For more details, kindly contact the customer care team.

Mobile Check Deposit Limits Bank Of America

Mobile check deposit Bank of America FAQs

There are several questions that individuals do ask themselves pertaining to the Bank of America. Nevertheless, the following is the most commonly asked questions that you will ever find in almost all platforms and forums.

Mobile check deposit BoA not working – what should I do?

In certain instances, you will find that the mobile checking deposit not to work. Usually, when there a massive system failure, clients are informed through their emails or texts. Again, if there is a planned maintenance program, you will be notified.

However, if you do not receive any notification and you experience a system failure, you are advised first to check your internet connection.

If the connection is strong, you should contact the customer care team to receive further instructions on what to do.

Maximum Mobile Check Deposit Bank Of America

References on BoA Mobile check deposit

Bank Of America Check Deposit Mobile Limit

- Bank of America: How to use Mobile Check Deposit for Fast & Simple Deposits

- LendEDU: Can you cancel a check?

Mobile Check Deposit Bank Of America Time

READ MORE: Banks with Mobile check deposit